Two Rivers Project

Regulation: CFTwo Rivers is a utility-scale solar project in Georgia currently under development by Solariant Capital.

Early investors get bonus rewards.

Top reasons to invest

- Direct access to solar project ownership

- Acceleration of renewable energy deployment

- Experienced developer

- Diversification to your portfolio

and get up to 20% additional units!

The exact number of bonus units will be calculated based on your investment commitment, and will be confirmed once the investment process is complete.

Please note the bonus tier structure* may be lowered if your investment tier crosses to another threshold.

5%

Previous Investor Bonus: All investors in New River Solar will receive an additional 5% bonus on their base investment.

Offering terms

Reg CF

$250

Crowdfunding Vehicle Units

Equity

$1.00

$1,235,000

Project summary

Technology

TechnologyPV

- 80MWac / 100MWdc Photovoltaic Solar on single-axis trackers

- Site: 750 acres in Camden County, Georgia

- Generation: 200,174 MWh in the first year

Carbon offset

Carbon offset156,000 Tons

- Annual carbon offset: more than 156,000 tons of CO2

- Equivalent to over 30,400 cars taken off the road or

- Equivalent to over 14,700 homes powered

Project status

Project statusUnder development

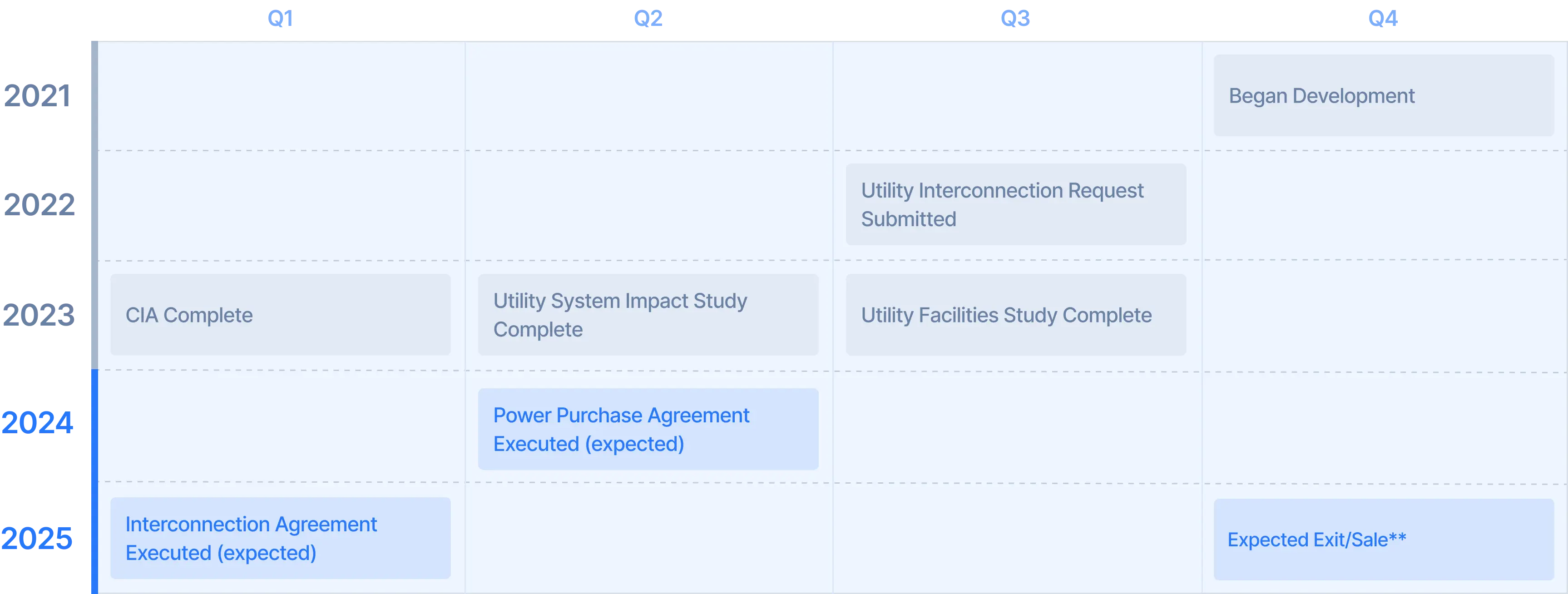

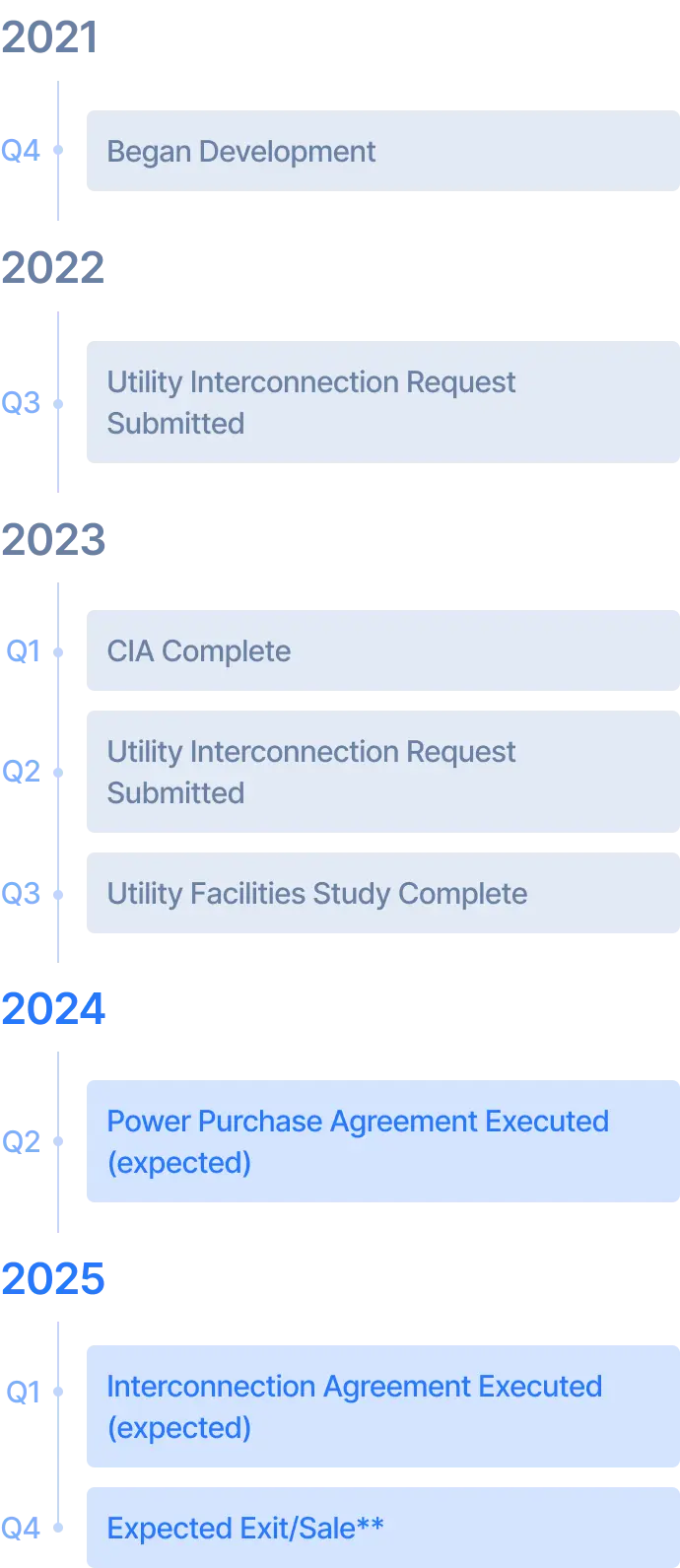

- Began development: Q4 2021

- Expected completion (exit/sale**): Q4 2025 (in 18-21 months)

- Completed: Site control and title search, feasibility studies, system impact study, site design and preliminary engineering, utility grid interconnection application

- In Process: Permitting, detailed engineering, offtake agreement, utility Facilities Study and Interconnection Agreement, EPC and O&M agreements

What am I investing in?

Step 1

Find and invest in a clean energy project

You will own a % of the development project based on how much you invest.

Step 2

Two Rivers uses the funds to complete the development stage

The goal is to get the project ready to be sold within 1-3 years**.

Step 3

Project get listed for sale**

If the project is sold, you'll receive a proportional share of the net capital after expenses and liabilities.

Step 4

Celebrate your Green Impact

Investing brings the world one step closer to a future powered by renewables.

** The sale or exit of the project cannot be guaranteed and if there is a sale or exit, a price cannot be guaranteed as several factors such as but not limited to market, economic conditions, and availability of buyers may affect the ability to exit the project.

More about the solar industry

How investing in solar projects works

A developer, like Solariant Capital, handles the planning and preparation process and sells** the project to its long-term owner.

Solariant Capital, our parent company, has over 10 years in experience successfully developing Solar Energy Projects.

Top reasons to invest

Direct access to solar project ownership

investors will own shares or units of solar projects in the U.S., an asset class traditionally reserved for institutional, accredited investors and private equity funds.

Acceleration of renewable energy deployment

the speed of renewable energy deployment is critical in effectively combating global climate change. By providing access to a wider pool of development capital, developers are empowered to pursue an increased number of renewable energy projects.

Experienced developer

Solariant Capital is an experienced renewable energy developer with more than 10 years of renewable energy project development experience.

Diversification to your portfolio

provides potential diversification benefits to your portfolio.

Introducing: Two Rivers Solar Project

This project will provide clean electricity to Georgia’s electric grid and add a new power supply to the area.

Learn more about Two Rivers

Click the plus sign for project details

- Battery energy storage connected to Two Rivers can harnesses excess solar energy generation efficiently and offers resiliency during disruptions in supply and demand for electricity.

- Georgia’s primary source of electricity is natural gas, presenting a prime opportunity to replace and supplement GHG-intensive power generation.

- The Two Rivers Solar Project is currently in the utility interconnection queue for approval in Georgia with an expected construction start date in Q2 2026.

- The Two Rivers Solar Project’s proximity to the point of interconnection with the grid should translate into reasonable facility and network upgrade requirements. These upgrades are the cost of interconnecting with the grid and typically represent a major cost variable for power plants.

- Transmission studies in the area previously showed ample available capacity for the grid to accommodate the Two Rivers Solar Project.

- The development, future operation, and maintenance of the Two Rivers Solar project is an investment in the local community and provides impactful opportunities for economic development, tax revenue, and job creation across multiple sectors.

Georgia solar market

- Georgia is currently ranked 9th in the U.S. with approximately 2,668 MW in total installed capacity.

- Southern Company aims for 14 GW of renewables by 2024 (goal is to cut carbon emissions 50% by 2030).

- In its July 2019 IRP, Georgia Power says it will grow its renewable generation to 5,390MW by 2024 and increase the company's total renewable capacity to 22% of its portfolio.

- Between two 2024 RFPs, Georgia Power expects to procure a total of 2,000+ MW at of new generation resources to meet growing demand.

Quick facts about Georgia's renewable market

* This Offering involves a bonus structure based on the timing of an investment relative to the remaining number of units for sale. Bonus Crowdfunding Units will be distributed to investors based on tiers:

- Tier 1: Individuals who purchase units in this Offering until 370,500 units are sold will receive one (1) additional unit for every five (5) units purchased.

- Tier 2: Individuals who purchase units in this Offering after 370,500 units have been sold, until 741,000 units are sold, will receive one (1) additional unit for every ten (10) units purchased.

- Tier 3: Individuals who purchase units in this Offering after 741,000 units have been sold, until 988,000 units are sold, will receive one (1) additional unit for every 20 units purchased.

- Prior Investor Bonus: Investors who participated in the New River Solar, LLC Regulation CF offering will receive an additional 5% bonus on their base investment, in addition to any other bonus tiers.

** The sale or exit of the project cannot be guaranteed and if there is a sale or exit, a price cannot be guaranteed as several factors such as but not limited to market, economic conditions, and availability of buyers may affect the ability to exit the project.

About the team

Daniel Kim

Managing Director

Kevin Kohlstedt

Head of U.S. Renewables Development

Sachin Verma

Assistant Director of Development

Eric Kang

Director of Finance

Leesa Nayudu

VP of Power Marketing

Jacob Wilson

Assistant Director of Engineering

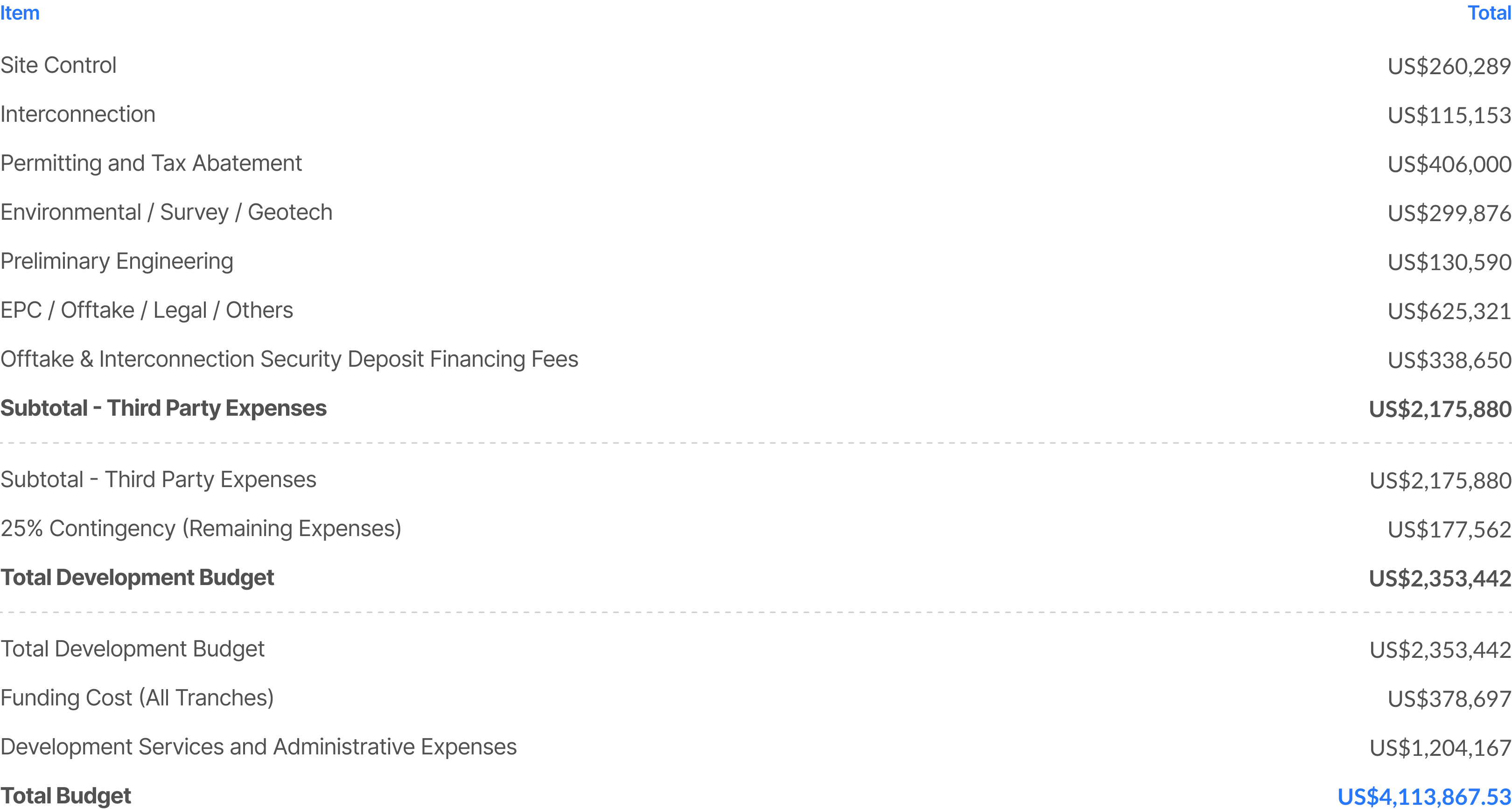

Project development budget

Project development status

Solariant Capital team members are successful, experienced project managers and developers that can effectively manage and develop projects.

- IN-PROGRESSSite Control and Feasibility

- IN-PROGRESSInterconnection

- IN-PROGRESSNatural Resource Studies

- IN-PROGRESSPreliminary Engineering

- IN-PROGRESSPower Marketing

- IN-PROGRESSPermitting

- IN-PROGRESSDetail Engineering/Constructability

The project’s current status is outlined in the TRC report. For a detailed breakdown you can download the document .

Project timeline

** The sale or exit of the project cannot be guaranteed and if there is a sale or exit, a price cannot be guaranteed as several factors such as but not limited to market, economic conditions, and availability of buyers may affect the ability to exit the project.

Frequently asked questions

What are Investment Limits for Reg CF funds?

What is an Accredited Investor?

How does the online investment process work for this Reg CF opportunity?

How long can this take?

Who is Andes Capital Group?

How does Andes Capital Group get compensated?

Am I now a customer of Andes Capital Group?

Why do I give information such as DOB, SSN, Driver’s License or Passport Details, Annual Income or Net Worth?

Where can I direct questions about the Issuer to get additional information?

Where can I direct additional questions about the investment application and process?

Updates

- Aug 29, 2024

Aug 29, 2024Two Rivers offering is successfully funded!

- June 6, 2024

June 6, 2024Two Rivers offering is now live!